Version

8.0 - CheckWriter Cloud User's Guide

Manual Home

CheckWriter™ Overview:

![]() Download

a .pdf of this page

Download

a .pdf of this page

Your CheckWriter

Cloud check

drafting software runs from just one main screen. All of the

controls you will use will be accessible from this screen.

TO PRINT THIS PAGE, RIGHT CLICK & SELECT PRINT

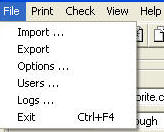

File

Menu

Import

Sample Import File

Generic WebDebit Form

Export

Options Menu

User Defined Fields

Selecting Default Payee - Autofill

File Path Options

Font Options

Users - Username and Password

Logs [user log]

Print Menu

Print Blank Checks

Print Check / Draft

Print an Invoice

Print Register Reports

Check Menu

Create a New Check / Draft

Create a Duplicate

Check

Reissue Checks - Monthly Billing

Save

Delete

First | Previous

| Next | Last

View Menu

Table View

Record View

Help Menu

CheckWriter Help - Manual

About CheckWriter

Exit

Search

-------------------------Record View

Customer Information

Company

Contact

Address

City, Sate, Zip

Phone Number

Email

Transaction Types

Standard Check

Custom Check

Credit Card

Routing Number

Account Number

Signature Options

Required

Not-Required

Facsimile

Draft Information

Date

Check #

Amount

Payee

Delivery Date

Delivery Status

Print On Check

RCCI - Remote Check Clearing Identifier

Memo

Bank Information

Bank Name

Bank City

Fraction Code

Notes

Toolbars

-------------------------Table View

Searches

Toolbars

Updates

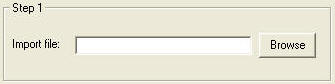

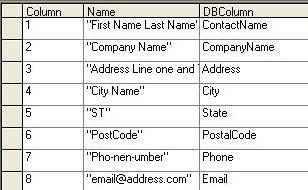

IMPORT:

Top

This feature allows you to import the following file types:

- .txt file

- .csv file

- CheckWriter™ 5.xx database with contents

- CheckWriter™ 4.xx database with contents

- WebDebit™ Import file

There are 4 steps involved in importing -

First, select

your file:

Second, Choose the delimiter, text qualifier or enter your own,

then select if you want to skip the first row upon import [if

the first row is the field names]

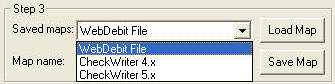

Third,

Choose a pre-made field map

for upgrades, or the WebDebit import file - or map the fields

manually below and then title your map and save it for later use

on the same file type.

If you are upgrading

from 4.xx to 5.xx, select to import the CheckWriter 4.x file.

Last,

Click Import Data. If you

have a large file, be sure to wait until you get the success

message.

If you have a large file, be sure to wait until you

get the success message.

If

you are using the WebDebit

import feature, please read the following:

- Below is a sample import file: Top

- Your Internet form, or shopping cart

should be configured to output to a text file much like

this one. Support on this feature is limited to

successfully importing the sample file below. No support

is available for user files.

If you cut and paste the file below to a text file, and save it as something.txt, you will be able to use CheckWriter's WebDebit™ Import feature to automatically enter this sample check.

_____________________________________

Field order key: [do not use this for a sample file]

"First Name_Last Name","Company Name","Address Line one and Two","City Name","ST","PostCode","Pho-nen-umber","email@address.com","CredtiCardNo.","exp","Name of the Bank","Bank City","ST","Fraction Code","1234","account_number","routing_number","MEMO FIELD Optional","Uliminted Data for Notes Field","Notes","Notes","Comments price field must be 4th to last field","TOTAL_USD","1 Jan 2006","ANY_required","ANY_required"

______________________________________

Sample Generic Form:

Top

- See - Free Forms and Tools

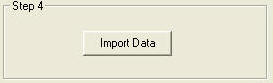

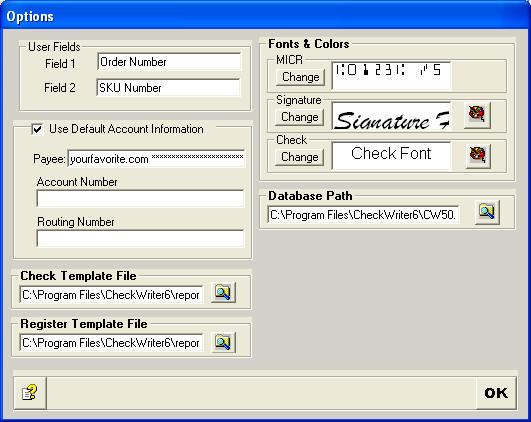

EXPORT:

Top

The easiest way to export your entire database in any order you

wish is using the export feature from the File Menu.

Simply map the export order and click Export - choose a file

format, text or csv and save.

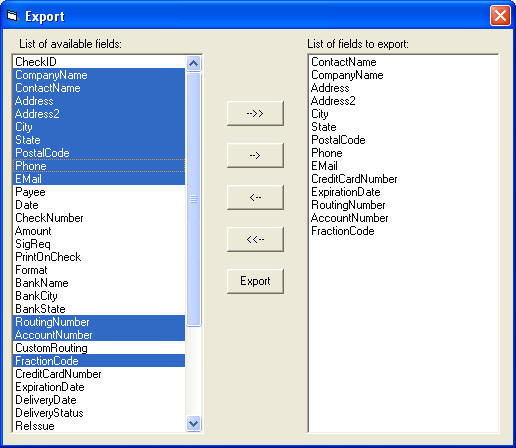

OPTIONS

MENU:

Top

The user fields can be titled anything you choose and are fully

searchable. Simply enter any name you choose for user

field 1 or 2 and this name will appear on the record view for

any entry.

Use this section if you want default information filled in for

each new check. Say you always pay checks to yourself,

enter your name or company name in the payee field and you will

not need to fill it in each time. If you print multiple

checks on the same account, your own perhaps, then enter your

account information here as well.

Checking or un-checking the "Use Default Account

Information" box will activate and deactivate this feature.

File Path options:

Top

Only use these options with the assistance of technical support.

Database path is available on the Network and Enterprise Edition

only.

Font Options:

Top

You can change the MICR font, the signature font, or the check face font

to fit your needs. We suggest you leave this section

alone, as everything is pre-set and if unaltered, your drafts

will print properly and be fully compliant with all banking

regulations

We recommend you use MICR E13 B 12 pt which is the default for

the MICR.

We recommend you use Brush Script MT, Italic 22 pt for the

signature font.

We recommend you use ARIAL 10 pt. for the check font.

Security

USERS MENU:

Top

The default Username and Password for all versions is

'admin' and 'admin'.

For the Single User Version, you can change the password, but not the username or options. All Single User Version have just one user 'admin' and all permissions are pre-set.

For the Network

Edition and Enterprise Edition, you can choose to create new

users and you can assign any level of permissions to these

users.

To create a new user, up to the total number of licenses you

have, click the New User button and enter any username and any

password, then click Save.

![]()

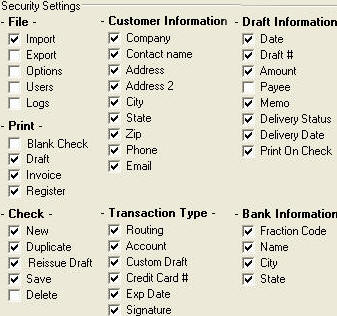

To set permissions for each user,

uncheck the boxes that correspond to the functions you want to

lock out.

In the example below, the user has been locked out of the

most compromising functions such as Export, Options, Users,

Logs, Blank Check printing, the ability to Delete a record and

the ability to alter the Payee.

[It is

strongly recommended with the Network Edition and

the Enterprise Edition to always lock out the Delete function -

except for the administrator, as this could cause database

locking. If all users do have permission to delete,

deleting should be done only when a single user is connected.]

USER LOGS:

Click on 'Logs...' in the file menu to see a detailed log of each user, the date and time the logged in and what they did. The log will show the changes made to each record, and includes all fields.

BLANK CHECK:

Top

This command allows you to

print a totally blank check with no amount, payee, signature or

pay to the order of, however, you can print the account name and

the bank routing and account number, allowing you to print blank

personal or business checks that can be used at retail locations

or to pay bills.

CHECK:

Top

Select this option to print a check draft from the record you

select. After selecting this option you will have a

choice:

Select yes and

CheckWriter™ will print a top check, a check stub duplicate check

on the middle portion and a receipt that can be inserted into a

standard #10 business envelope on the bottom portion.

Select No and CheckWriter™ will print 3-per page

checks. This should be used only with 3-per page check

stock during a batch print.

INVOICE:

Top

Select this option and CheckWriter™ will print an invoice for the

selected record. You can tri-fold this invoice to fit a

standard #10 window envelope.

REGISTER:

Top

Select this option and CheckWriter will print the register for

the current selection of records. If you have a large

number of records, you may want to split up printing by

selecting categories. The register report also calculates

totals.

NEW:

Top

New

allows you to add a fresh, never before entered customer profile

into the database. When you select this option an empty record

appears. You may begin adding, and use TAB to move between fields.

DUPLICATE:

Top

This allows you to make a new, or duplicate copy of an existing

check without re-entering data. Select this option and

CheckWriter™ will enter new payment data in the notes field and

queue the new check to print. Be sure to update amount and

check number fields manually. The date will update

automatically and the check number will advance by 1

automatically. Never overwrite old data or you will lose the

history in your database.

REISSUE CHECKS:

Top

This allows you to set up monthly or periodic billing.

Simply enter the number of payments to be made and the day of

the month the payments are due in the records you wish to

bill. Then, when you want checks to issue, select reissue

checks from the check menu and all checks within the specified

date range will be queued to print.

![]()

An entry such as above would issue 5 more checks on the 15th of each month. After reissue was selected, it would change to 4 and 15.

SAVE:

Ctrl + S

Top

Use this option

to save an existing entry after it has been updated.

DELETE:

Ctrl + D

Top

Use this option

to remove all traces of a customer’s record in the database.

The program will ask you for conformation before deleting a

customer record.

FIRST:

Top

This function will automatically go to the first record in the

database.

PREVIOUS:

Top

This function will automatically go to the previously viewed

record in the database.

NEXT:

Top

This function will automatically go to the next record in the

database.

LAST:

Top

This function will automatically go to the last record in the

database

TABLE VIEW:

Top

Select this view to see all records as a table. This is

where you perform searches and do batch billing and printing.

RECORD VIEW:

Top

Switch to record view to enter new customers, scroll, or view

any selected record from table view.

CHECKWRITER

HELP:

Top

Click this option to view the manual.

ABOUT:

Top

Click this option to

see version and system data.

EXIT: Top

Select Exit to quit the program. Restarting will require a password.

Customer

Information:

Company:

Top

Enter the name of the company writing the check. You can select

to print or not print this information on the face of the check.

[required or contact name required]

Contact

Top

Enter the

customer’s name in this blank, this information can be

included or excluded from the face of the check, just like

"Company." [required or company name required]

Address:

Top

Put Street Adders of customer here. Include any unit numbers on

this line also (i.e. 84 Gainsborough St., Suite 105W) This is

what will appear on the check in the address box. [strongly

suggested but not required]

City, State, Zip:

Top

Enter the city, the state and the zip code of the customer in

the respective fields. [strongly suggested but not required]

Phone:

Top

Enter the customer’s primary phone number. [strongly suggested

but not required]

E-mail

Address:

Top

Insert the customer’s E- mail address here. [not required]

Record View Entry Screen:

Transaction

Type:

Top

Standard: Top

Standard format is:

C00123C A011000206A 1234567890C

which is the same as

A011000206A 1234567890C 00123C

and can be written either way.

Select standard format if you get any check with a 9 Digit routing number, 6-14 digit account number, and any number check number. 99% of your checks will be like this.

Routing Number:

Top

Enter the customer’s bank routing number, usually 9

characters. This can be easily differentiated from the account

number by looking at the fraction code which has the routing

information in a similar format.

Routing numbers are always between the

|: symbols like this

|:011075150|:

Version 5.0 and later have a built-in routing number

verification routine that will run the check digit of the

routing number against a mathematical formula. If this formula

matches the check digit, your routing number is a possible

match.

On rare occasions, this utility will be wrong. Some credit

unions and older branches still use NON STANDARD routing numbers

that do not comply with the formula. It is always best to

double check if the routing number does not verify. [the routing

number is required to process a valid check or draft]

Account Number:

Top

Enter the customer’s account number in this blank. Usually 10

numbers. [account number required to process a valid check or

draft]

NOTE: If the routing number and account number have the ‘D’ or

D symbol or take on an unusual format, you should select Non-Standard format.Non-Standard:

Top

Use this option for Non-Standard

checks from

- Credit Unions

- International Checks

- Alternative Accounts

- Money Market Account Checks

- Other Non-Standard formats that use MICR

CUSTOM CHECK:

Top

If you receive check information that does not come in the

standard format, you will need to build the account encoding

yourself.

Enter the check information using the code supplied when you select the Non-Standard option. It should be A=

A B=B C=C D=DIf the account

was

A011000206A

0423D25410D21100C

You would enter

A011000206A 0423D25410D21100C

Credit Card:

Top

Select this option if your customer is paying by credit-card.

Simply enter the card number and expiration date. CheckWriter

will not authorize the card but will file the information on

your customer and make it available for reports and searches. If

you are importing numbers of orders to CheckWriter, you can also

import the card orders. You can use the invoice feature to

print an invoice, or assemble the new card orders for export and

import them into another credit card authorization program like Authorize.Net.

SIGNATURE

OPTIONS:

Top

Select the signature option that most suits the

situation.

Not Required is the default setting. This option

will print a signature disclaimer on the draft stating that

there is no signature required and the draft is authorized by

the depositor. This should always be used for drafting.

Required

prints the draft with a blank, allowing the actual account

holder to sign their name. This option can also be used if

you have a signature stamp to use on the draft. This is not

intended to be used for printing checks.

The Facsimile option will print a signature Facsimile in

a script font with a disclaimer underneath the scripted

signature stating the signature is a Facsimile. Use this option

for printing rebate checks, large run items, payments from your

own account, but not for drafting.

Date: Top

This will automatically update to today’s date when you are updating a record, but if no updates are made it will remain the date of last update. You can change this field at will. [automatic and required]

Check #:

Top

Enter the check number the customer wished to use for payment.

You can use 0000 if there is no check number available. This

will appear as 0 in the check number field, but all check

numbers will print as 4 digits or more on the check face.

Leading zeros beyond 4 characters are dropped automatically.

[required that at least 0000 be entered]. CheckWriter prints

drafts to regulation with check numbers up to 8 digits. If

you are drafting a check with a check number that is longer than

8 digits, enter the first 8 digits from the right - so if the

check number were 123456789 you would use check number 23456789.

Amount:

Top

Enter the amount of the check you are writing. [required]

Payee:

Top

Here you can override the default payee and enter any payee you

wish. This is what will appear in the Pay to the order of

field on the check. [required]

Delivery Date:

Top

Use this field to enter the date the product was or should be

delivered. This is a reference field only and does not effect

check printing. Many people use this field to do monthly

billing. You can search for the bill date and charge all

customers with a delivery date of that day. [not required or

part of the draft]

Delivery Status:

Top

Use this field to update the status of a delivery. This is a

reference field only and does not effect check printing. [not

required or part of the draft]

Print On Draft:

Top

CheckWriter will automatically print the company name on the

draft if both company and contact are entered. If you enter just

a contact name, CheckWriter will automatically print only the

contact name. The same applies if you enter only the company

name, CheckWriter will know to print the company name on the

draft.

To change this manually, use theh Print on Draft drop down box

to select if the draft is to display the person's name or the

company name in the top left of the check. The default is

Print on Draft: Company.

RCCI -

Remote Check Clearing Identifier

The OPTIONS menu contains the check box for default RCCI.

If checked, all drafts will issue with the RCCI as ON. If

unchecked, the RCCI default is off.

![]()

You can change the RCCI settings on a per item basis from the

main screen using the RCCI drop down box.

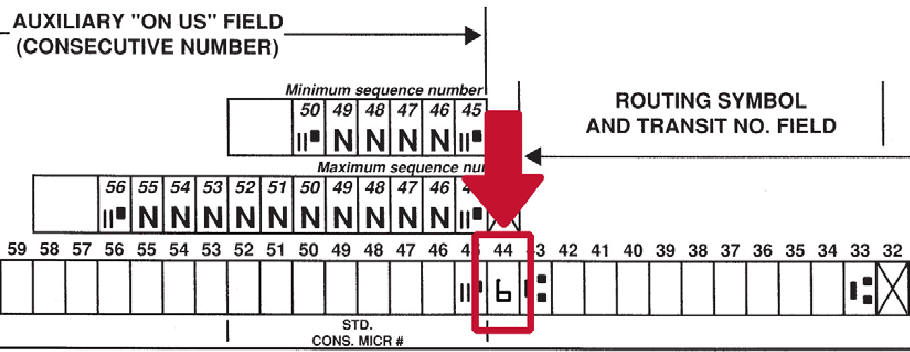

When set to ON the RCCI - which is the number 6 - will appear in front of the routing number in position 44 on the MICR code line. This is required for all Remotely Created Check Drafts or items printed with NO SIGNATURE REQUIRED.

Memo:

Top

This information will be printed on the memo section of the

check and on the stub, mailer stub and invoice. [not required -

will print on face of check]

Bank Name:

Top

If the customer

is paying by check the name of the customer’s bank goes here.

This is printed on the face of the check. If the customer pays by credit

card, you may choose to enter the card type or bank name here.

[advised but not required - if unknown lookup in RoutingTool]

Bank City:

Top

Enter the city or

town, and state the customers bank is in. This will also print

on the face of the check. [not required]

Fraction Code:

Top

Enter the

fraction at the top of the customer’s check. It should look

something like this (5-20/110) Note: If you have multi-line

fractions such as:

5-201/4587 (32)

0254921100

It should be

entered as only the top number. Omit the bottom code. This is

not necessary to process the check.

Some checks will not have a

fraction code at all, this is also okay. Use the fraction if it

is available, but if not, your draft will still be processed.

[fraction code not required]

Notes:

Top

This section can

be used for absolutely anything. Take notes here to cut and

paste into check fields, make account notations for future reference, type anything here, even paste info in about your

customers. This will not appear on the check, but will appear on

the invoices. Duplicate check history is stored here as

well.

![]()

FIRST | PREVIOUS | REC'D# of TOTAL | NEXT | LAST

PRINT DRAFT | INVOICE | TABLE/RECORD VIEW | HELP |EXIT

-----

![]()

![]()

Search by any field in the database.

![]()

Showing all records may make reporting or printing large batches unmanageable.

![]()

Try to narrow your search. This is more manageable:

![]()

![]()

Searching for unprinted checks will bring up checks just imported,

checks queued after re-issue, or manually entered checks that have

not yet been printed.

![]()

![]()

Select a date range to view and run checks or reports based on this

criteria.

Quick Searches:

![]()

![]() To

do a quick search, use the binoculars toolbar button. Put

your cursor in any field, then click the button, enter the

search criteria.

To

do a quick search, use the binoculars toolbar button. Put

your cursor in any field, then click the button, enter the

search criteria.

For example, to search for a record in zip code 02115, click the

zip code field in the software's main screen, then click the

binoculars. Enter 02115 and then search - All records

matching your search will be displayed for you to scroll though,

or flip to table mode and run a report or export from the

results.

CheckWriter™

is trademark product from yourfavorite.com.

© Copyright 1996-2016 All Rights Reserved.